If you already have an account, we'll log you in

Sun 28th Apr:

Hong Kong 3 RSVPs

Sun 28th Apr:

Hong Kong 3 RSVPs

Sat 27th Apr:

Seoul 5 RSVPs

Sat 27th Apr:

Seoul 5 RSVPs

Thu 25th Apr:

Bangkok 1 RSVPs

Thu 25th Apr:

Bangkok 1 RSVPs

Tue 23rd Apr:

Tokyo 4 RSVPs

Tue 23rd Apr:

Tokyo 4 RSVPs

Tue 23rd Apr:

Asuncion 3 RSVPs

Tue 23rd Apr:

Asuncion 3 RSVPs

See upcoming meetups

See upcoming meetups

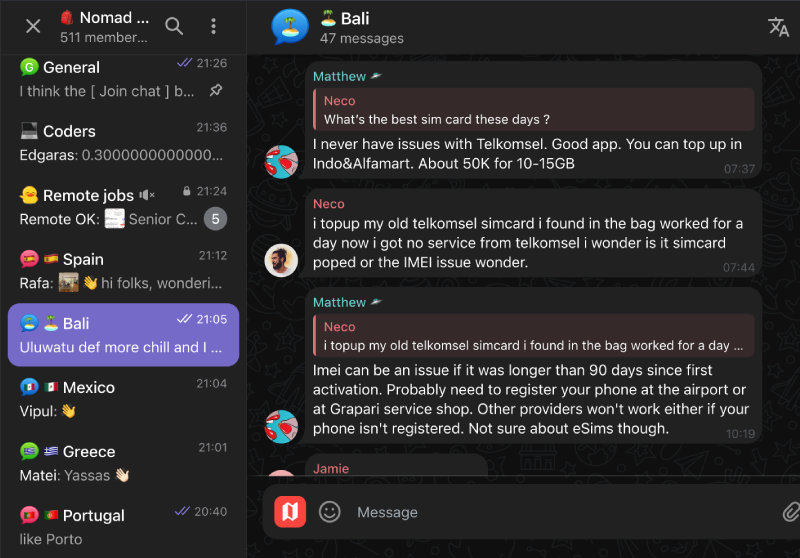

Join Telegram chat

Join Telegram chat

{descriptionFromReview}

{label-main-score} 💵 Cost 📡 👍 Liked 👮 Safety {bottom-left} {top-left} {bottom-right} {top-right}Can't login? See the FAQ

By signing up, you agree to our terms of service and community guidelines.

One-time-payment: $39.98 $19.99 💫2024 NEW YEAR 0% off

Billed once. Then never again

Nomad List members

work remotely at

💖 Thanks for signing up! I hope you like my site. I put a lot of effort into making it.

📬 First, please go to your email and click the confirm link first to verify your email address, check your spam folder if you can't find it

💌 After you confirm your email we'll send you an email with more info

👩💻 You can start using Nomad List's member-only features now!